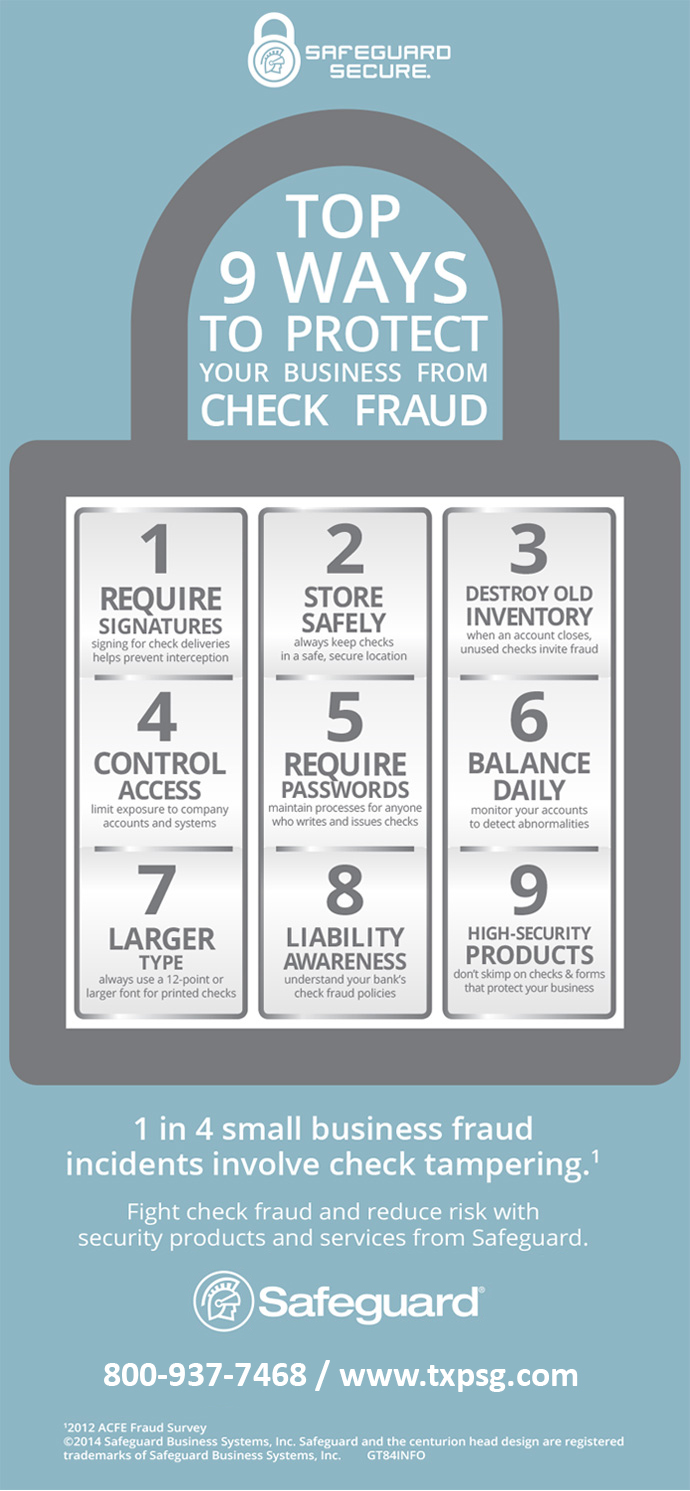

One in four small business fraud incidents involves check tampering. But proven strategies and best practices can help minimize your risk of falling victim to this kind of theft.

Here are the top nine:

Are you at risk for check fraud?

Best practices to manage your risk:

- Require Signatures When you order new checks, choose “signature required” upon receipt to make it harder for anyone who tries to intercept them before they arrive.

- Store Securely Nearly half of all organizations don’t recover any of the fraud-related losses they suffer.1 Storing checks in a safe, secure location with restricted access is a common-sense approach to check handling that can help prevent these kinds of losses.

- Destroy Old Inventory All a check fraudster needs is a color copier and 60 seconds to start inflicting damage on your bottom line. Make sure you destroy your old checks and remove the temptation they provide.

- Control Access Up to 30 percent of a company’s employees will steal something at one time or another.2 Just like old check inventory, too-easy access to company accounts is a tempting target for fraud, so limit access to accounts payable areas and systems.

- Require Passwords Less than half of small businesses secure documents properly, either in locked files or with password protection.3 Require your employees to use passwords that mix uppercase and lowercase letters with numbers and symbols.

- Balance Daily A recent survey found that 26 percent of respondents had been hit by frequent check fraud attacks.4Balancing your accounts daily will help you detect any abnormalities as soon as they occur.

- Use Larger Type In order to make printed checks more difficult to alter, you should always use a font size of 12 points or larger.

- Understand Your Liability Take time to learn more about your bank’s policies regarding check fraud to understand how you’re most vulnerable and where you have the most liability. Use what you learn to develop measures for protecting your business.

- Use High-Security Checks The technology to prevent check fraud already exists. Advanced features within high-security checks make copying them nearly impossible and let recipients instantly test their authenticity. They may cost more, but they’re well worth it.

1The Association of Certified Fraud Examiners

2National Federation of Businesses

32013 Bank of the West Survey

4Association for Financial Professionals (AFP), 2012

Comments are closed.